TAM Priorities

The Trucking Association of Massachusetts has a variety of goals and priorities.

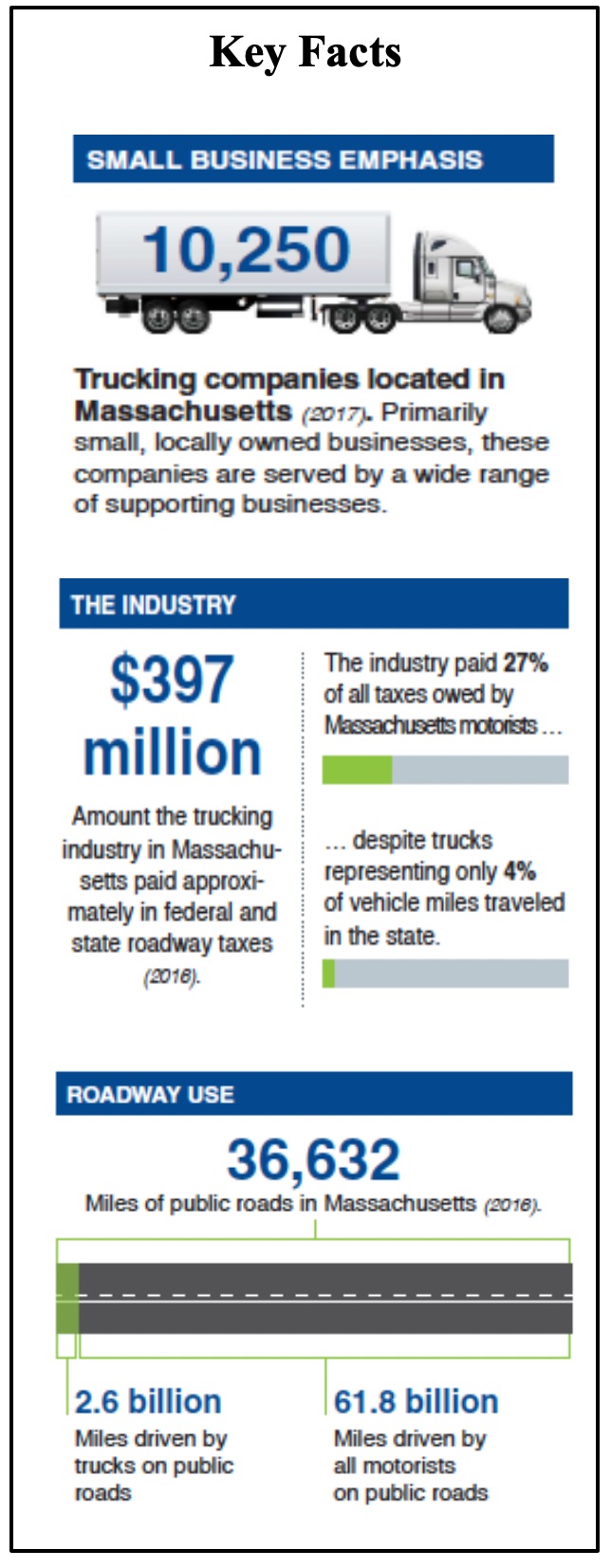

Trucking Companies

Trucking Industry Jobs

Roadway Taxes Paid

Protecting Trucking Companies in Massachusetts

TAM will continue to support legislation and create initiatives that ensure Massachusetts residents are served effectively, and to foster a better business environment in our state for Trucking.

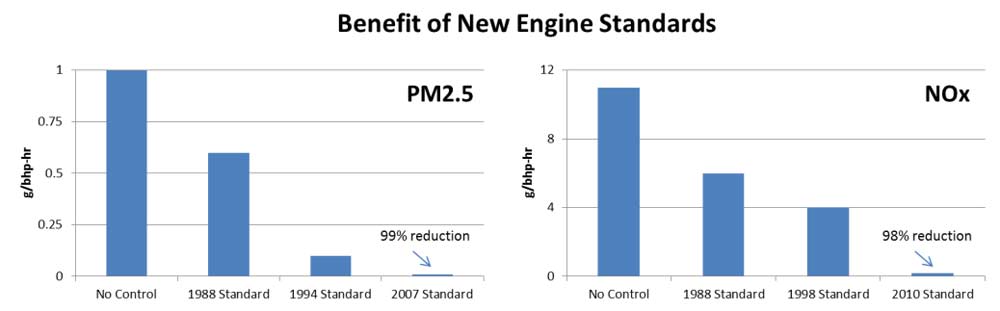

- Advocate for legislation that provides safer and cleaner vehicles

- Promote awareness of the unforeseen impacts of the Transportation Climate Initiative to our economy and jobs

- Advocate for better understanding regarding current tax laws that put all MA trucking companies at a disadvantage and exacerbates the ongoing exodus of trucking companies and jobs in Massachusetts

Workforce Development

TAM will continue to identify resources and develop innovative campaigns to help develop the trucking industry in our State. Our State currently has many deterrents for Trucking companies to domicile in Mass which has led to a decline in jobs while other states have seen increased opportunities.

Best in Class Regulatory Support

The regulatory environment in Massachusetts for trucking is complex, far-reaching, and intense. TAM will continue to be relentless in its efforts to support Its members in their ongoing regulatory and compliance efforts.

Lawsuit Abuse

Abusive crash lawsuits threaten our supply chain, leading to empty grocery store shelves, more expensive goods and elimination of jobs. Additionally, this litigious environment is creating major disruptions in the excess insurance market forcing trucking companies across the state and nation to close their doors.

Telling our Story

Trucking is one of the most under-appreciated industries in the country. Because the industry is so good at what it does, the average person doesn’t give a second thought to how products get to shelves or how vaccines get into arms. We have a great story to tell, and TAM will continue to be passionate in reminding everyone about the value of what we do.

On any given day, there are tens of thousands of people being trafficked into and within the United States. A large percentage of these victims are minors, often young females, who are brutally forced to preform commercial acts of sex or labor against their will.

On any given day, there are tens of thousands of people being trafficked into and within the United States. A large percentage of these victims are minors, often young females, who are brutally forced to preform commercial acts of sex or labor against their will.